pros and cons list carbon tax

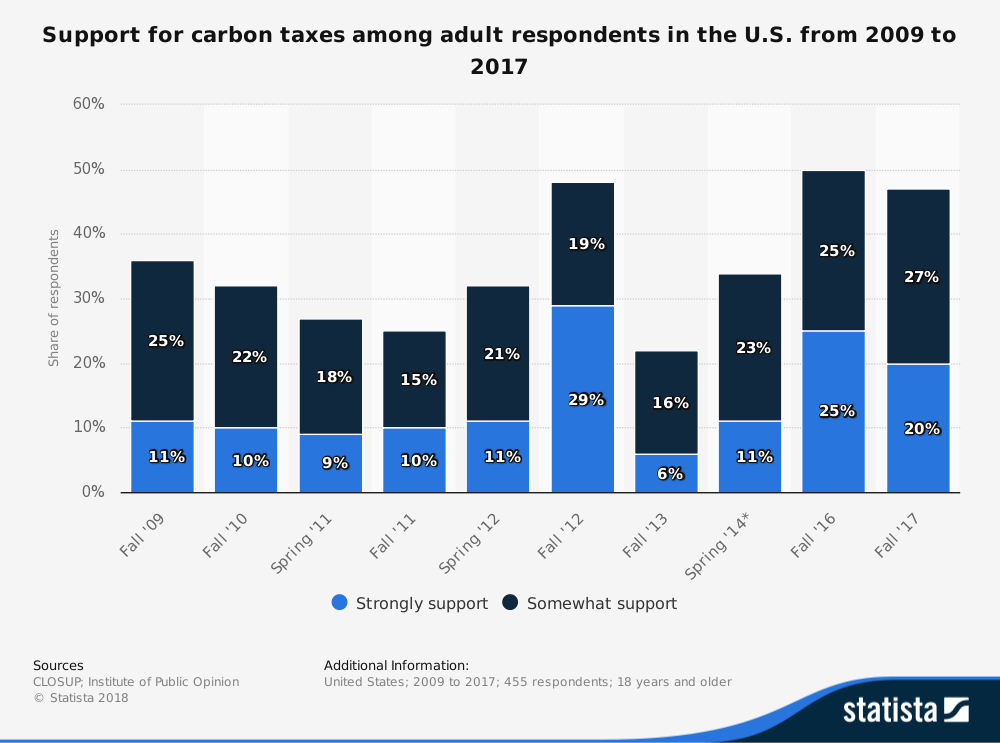

10 11 12 13 60 61 Carbon taxes can increase electricity prices. Many companies cant reduce their emissions as much as theyd like to.

Carbon Tax Pros And Cons Economics Help

There are three big problems with the concept.

. The low-income earners will end up paying a substantial percentage of their income for necessities like food electricity and gasoline. The market price is P1 but this ignores the external cost of pollution. One advantage of a carbon tax would be higher emission reductions than from other policies at the same price.

The Pros and Cons of Carbon Tax. Instituting a carbon tax could help reduce the deficit and produce incremental benefits for. Some countries have already adopted such a tax and discussions are ongoing in others.

Proponents claim that a carbon tax would be the most cost-effective way to cut carbon-dioxide emissions. List of the Disadvantages of a Carbon Tax. Also carbon taxes provide a broader scope in terms of emission.

The tax could be used to subsidize lower-income people who might have trouble paying energy costs. Carbon pricing is regressive. The potential of a carbon tax might be worth over 100 billion per year in the United States but it is also a system which requires a.

A carbon tax reflecting the social cost of carbon is viewed as an essential policy tool to limit carbon emissions. However if the tax rate grew slowly it could produce rising revenues Carbon Tax Congressional Budget Office CBO. An increase in the cost of fossil fuels will impose a harsh burden on low-income earners.

2 Ministry of Finance Sweden 5 Global Outlook Why a carbon tax can work well in developing countries. Since the government regulates how much emissions are allowed emissions will never rise past their cap. Almost everyone uses carbon-based fuels exclusively.

However a cap-and-trade policy offers its own advantages in that emissions allowances can be allocated so as to minimize the policys negative effects on. Carbon taxes have been suggested as a way to internalise the negative externality of carbon emissions. Arguments Against Carbon Taxation.

The carbon tax is generally levied on fossil fuels. 8 58 59 Most economists assert that carbon taxes are the most efficient and effective way to curb climate change with the least adverse economic effects. Reduce economic growth and investment.

By a carbon tax would eventually decline as well the effect on emissions during the 20122021 period is incorporated in the revenue estimate above. Levy on carbon tax increases the cost of operation discouraging investments and economic growth in the country. A carbon tax is a simpler blunter tool which is easier to administer and regulate.

A carbon tax might lead me to insulate my home or refrain from heating under-occupied rooms thus reducing emissions at a lower cost than by using expensive electricity generated from green sources. A much more straightforward plan is simply to tax carbon directly. A carbon tax has a major advantage over cap-and-trade and a hybrid version because it allows for carbon price certainty is less costly to administer and is a substantial source of revenue.

It removes the arbitraging games and artful dodges that have helped undermine cap and trade schemes in places like Europe but in return it requires that politicians vote for a tax. The administration of a carbon tax has relatively high fees. Research shows that carbon taxes effectively reduce greenhouse gas emissions.

High taxesWhen the demand is high the government increases the taxes so that people can look for alternative source of energy and reduce demand. Saturday 6 December 1997 1200AM view full episode Keith Orchison says a carbon tax on fossil fuels is unlikely. Contrary to that the carbon tax has a chance to incentivize emissions even lower than a set goal but there is no guarantee.

List of the Cons of a Carbon Tax. The revenue could be used to. The proponents claim this would be easy to administrate as there are already special taxes in place in the energy sector that can be used as the foundation to the new carbon tax policy.

Lower emissions mean cheaper everything allowing for greater profit margins. And indeed that they keep voting to raise it year after year. The Pros of Carbon Offsetting.

Researchers modeled three different carbon taxes starting at a per-ton rate of 14 rising 3 percent a year 50 rising 2 percent a year and 73 rising 15 percent a. Indeed within twenty years a modest carbon tax can reduce annual emissions by 12 percent from baseline levels generate enough revenue to lower the corporate income tax rate by 7 percentage. This means that consumersproducers will pay the full social cost of.

Carbon taxes produce explicit revenues. Carbon offsetting has benefits at both ends of the process. There are additional benefits to be reaped from the implementation of either a carbon tax or CAT system other than just a reduction in emissions.

If the policy were to be enacted a large percentage of a countrys carbon emissions will be monitored and sanctioned. But the carbon tax keeps running aground. High prices for carbon-emitting goods reduce demand for them.

Most supplies are either provided by. The problem with a carbon tax is that almost no one uses any form of renewable energy on a regular basis. Carbon Tax - The revenue that a carbon tax generates can be used to encourage investment in more renewable energy projects by offering subsidies to companies who build low or no-carbon plants.

A carbon tax of P2-P0 would raise the price to P2 and cause a more socially efficient level of output. Carbon taxes would create new tax revenues and it remains to be seen how that money would be used policymakers would decide. Carbon taxes are adjustable.

The downside is that you need to guess how high to. Low administrative costs is easy to administer can be added to. It helps environmental projects that cant secure funding on their own and it gives businesses increased opportunity to reduce their carbon footprint.

Advantages of Carbon Taxes.

Carbon Tax What Are The Pros And Cons Climateaction

Carbon Tax Pros And Cons Economics Help

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

What Are The Pros And Cons Of A Carbon Tax Elawtalk Com

27 Main Pros Cons Of Carbon Taxes E C

18 Advantages And Disadvantages Of The Carbon Tax Futureofworking Com

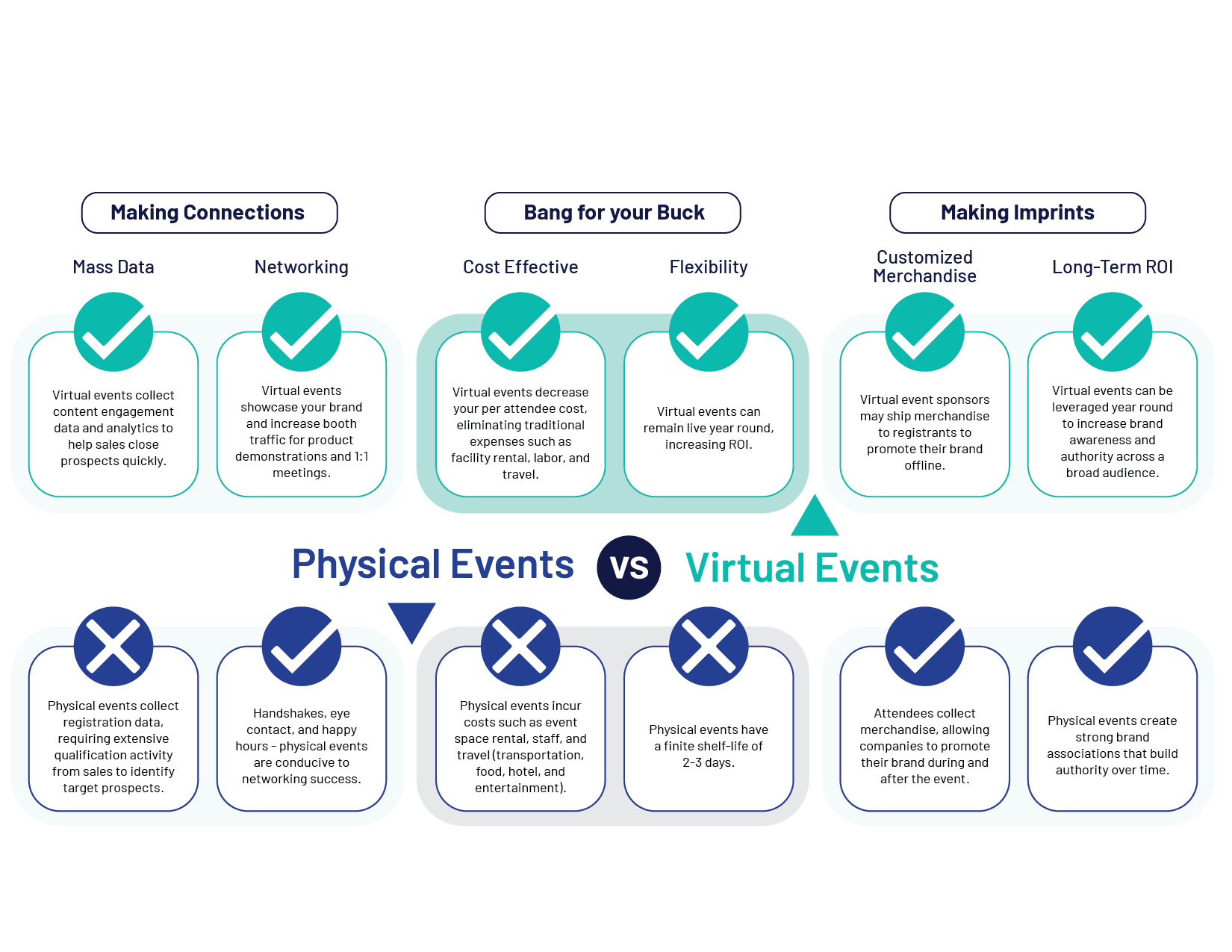

Pros And Cons Of Virtual Events Vs Physical Events 6connex Hybrid Events Software

Summary Of Qualitative Assessment Major Pros And Cons Of Different Download Table

What Are The Pros And Cons Of A Carbon Tax Elawtalk Com

Advantages And Disadvantages Of Multiple And Single Sourcing Strategy Download Table

Commentary Not All Plastic S Carbon Footprints Are Equal Recycling Today

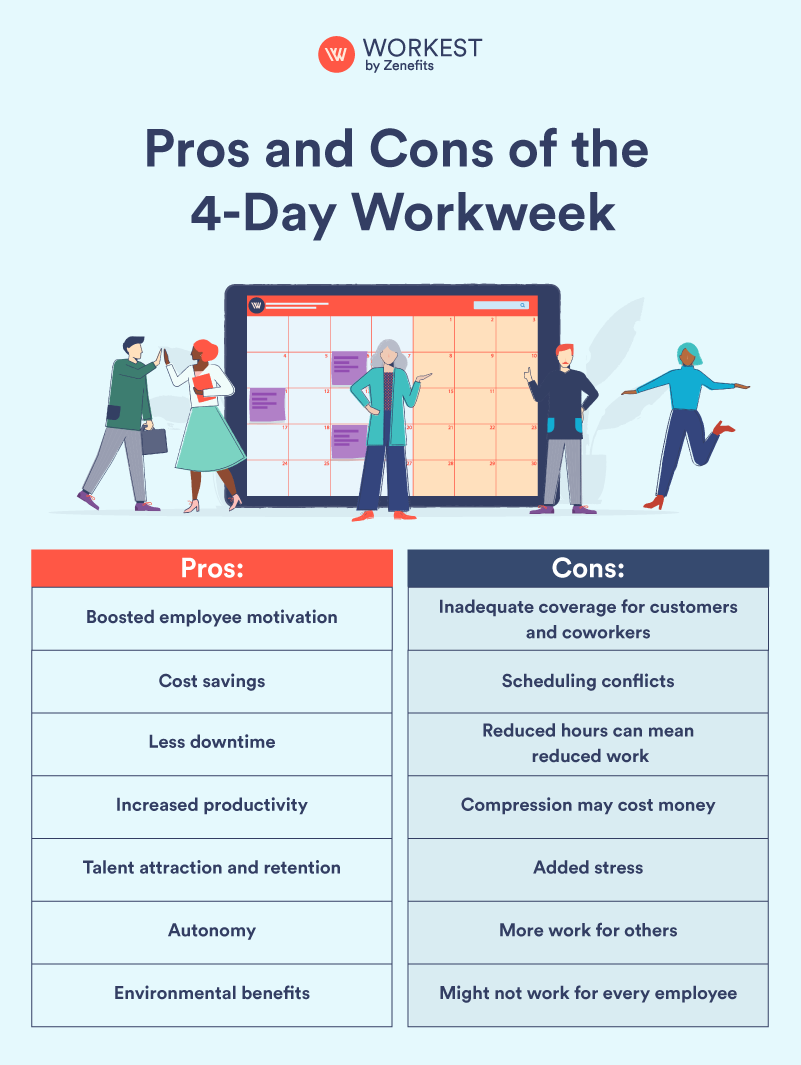

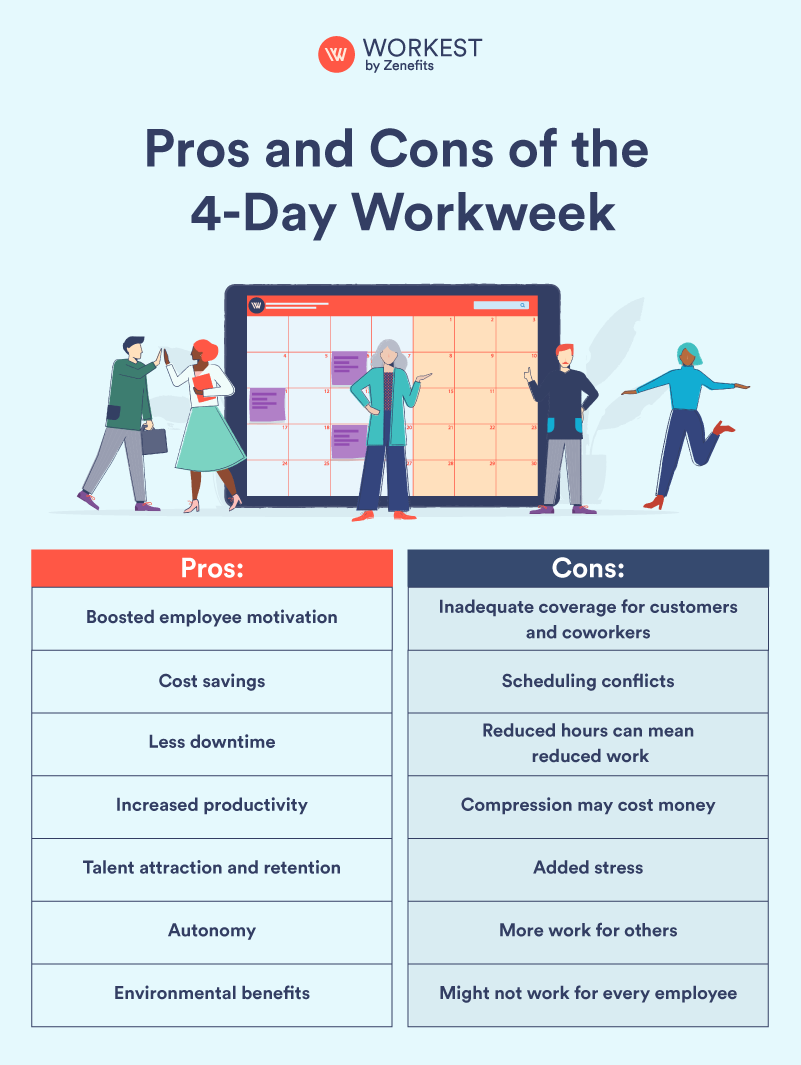

The 4 Day Workweek Pros And Cons Workest

Carbon Tax Pros And Cons Economics Help

Carbon Tax Pros And Cons Economics Help

Carbon Tax Pros And Cons Economics Help

Carbon Tax What Are The Pros And Cons Climateaction